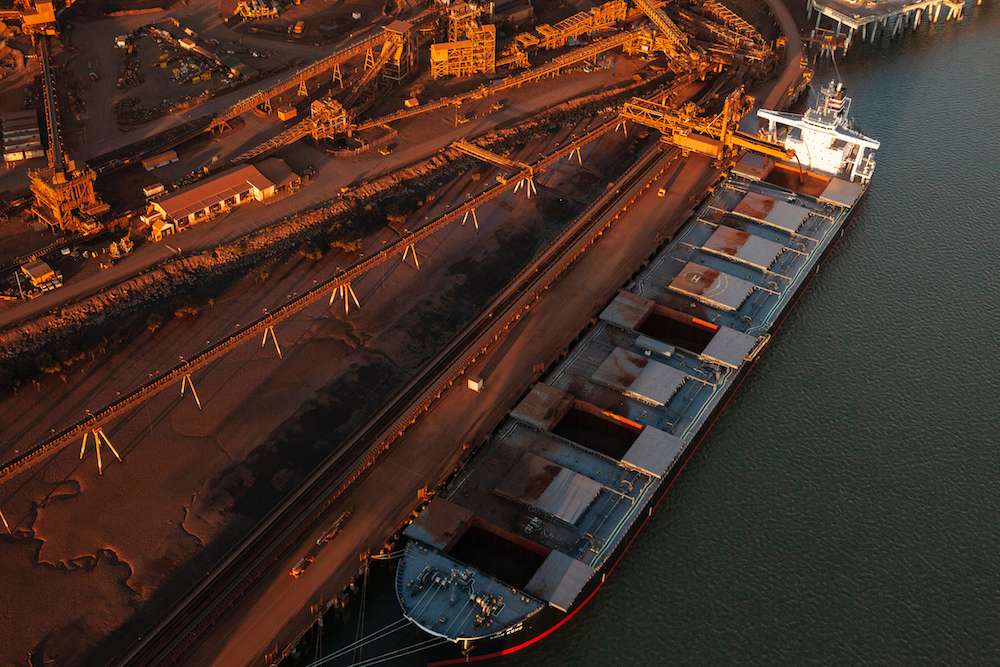

Queensland mining and resource companies tipped $117 billion into the state’s coffers in 2022/23. A key industry over many decades, QLD’s resource sector continues to grow, accounting for one in every four dollars spent in the state at last count and, impressively, 1 in 6 jobs. Digging into the numbers reveals that coal is still a significant driver of employment and spending, responsible for over two-thirds of the Gross Regional Product (GRP) during the financial period. Together, mining and resources secured over half a million jobs in the Sunshine State, adding a further $22 billion to its bottom line over the past 12 months.

Chief Executive at the Queensland Resource Council (QRC), Ian Mcfarlane, championed the results but pushed for further industry support. “Queensland’s current prosperity is the result of decades of past investment by mining and energy companies from all around the world as well as by companies based right here,” he said.

“If the government wants the resources sector to continue to support economic growth and jobs, it needs policies that encourage new investment and stimulate a pipeline of new projects in the years and decades to come.” QLD Mining and energy firms splashed $33 billion on goods and services over the year, purchasing these from almost 16,000 Queensland businesses.

WA set a new record for lithium exports in the 2022/23 financial year as critical minerals continue to climb the value chain. Reaching a hefty $21 billion in trade value, lithium is experiencing a boom as demand for Electric Vehicles (EVs) and associated technologies increases worldwide. While paling compared to Iron Ore, with $125 billion in export value, lithium’s rise does signal Australia’s bright future as a critical player in the energy transition. However, the picture may not be all pretty, with some in the field sharing their concerns as a buying spree of lithium assets continues across WA. One of Australia’s largest miners, Mineral Resources (MinRes), has just acquired 100% of Pantoro’s lithium, nickel, copper and cobalt rights at the Norseman gold project.

MinRes has also recently splashed $19 million on emerging player Wildcat resources, alongside a 12% stake in Azure minerals.

Majors, like Gina Rinehart’s Hancock Prospecting, are throwing their weight around, too, on the hunt for beneficial lithium assets, while others are happy to take a back seat for now. Chief Executive Officer of Arcadium Lithium, Paul Graves, thinks WA lithium assets may be significantly overvalued.

“There’s a massive disconnect today – massive – between the value someone’s ascribing to a very, very, very early stage, or technically challenging, projects in Australia with only a maiden resource (and) without full ownership,” Graves said.

“There’s a lot of value being assigned to those by various people down there in Australia, and so (it’s) a little challenging to me, to be perfectly honest, to know where the Australian M&A (mergers and acquisitions) market plays out.”

According to recent data, rooftop solar panels in New South Wales are generating enough power to force coal-fired power plants to turn down amid negative price inversions. The Australian state with the largest coal-fired power capacity, NSW, has traditionally relied on a wealth of fossil fuels and infrastructure for its baseload power. Renewables have caught up, however, and the state is now experiencing times when it has 100% “potential” renewables for the first time. These events occurred when rooftop solar systems were most active in the middle of the day.

Analysts expect negative price events to continue until more storage is built and demand rises via electric vehicles, household electrification, and green hydrogen production. The flow-on effect is that the state’s coal fire power plants are dropping capacity significantly, from 8.2 GW to just 1.6 GW in some cases, and reducing coal’s share of electricity generation to just 16%.

Dust suppression is a critical issue in the world of mining and resources.

Learn more about GRT’s industry-leading and IoT-connected SMART Dosing Units, and discover how we’re driving better dust suppression solutions for all!

If you’d like to talk with an expert, simply contact us!

Your feedback is important to us.

If you enjoyed reading this Global Road Technology industry update and found it informative, please let us know by leaving a REVIEW.

References:

https://www.qrc.org.au/media-releases/new-report-confirms-qld-economys-reliance-on-resources-sector/

https://www.mineralresources.com.au/investorresources/latest-asx-announcements/

Are environmental regulations, health and safety concerns or potential profit loss a concern right now?

Contact Us Now